Shareholder’s Right to Information in a German GmbH

Control Rights & Right to Disclosure

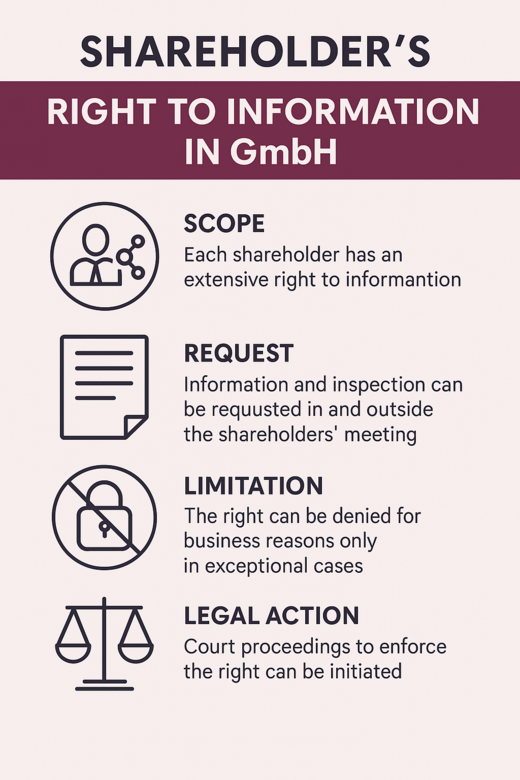

Every shareholder of a GmbH (German limited liability company), especially those who must make important operational decisions but are not involved in management, requires access to information. The German GmbH Act (GmbHG) grants each shareholder – regardless of their level of participation – extensive rights to information, the right to disclosure, and the right to inspect business documents. These rights can be asserted against the GmbH and its management. In practice, these rights are often used to monitor management but can also be leveraged to demonstrate influence or pursue corporate political objectives.

If necessary, the required information can be enforced through a lawsuit against the GmbH. In this article, we will show you how information policy works in German GmbHs from a legal perspective and when the managing director is authorized - and even obligated - to refuse an information request.

For a non-binding inquiry, please contact one of our experts directly by phone or e-mail or use the contact form at the bottom of this page.

Information Rights: Control of Management and Active Shareholders

As a general rule, the most important matters are discussed at the shareholders' meeting. Prior to a resolution, the management is obligated to thoroughly inform shareholders about the key agenda items and any related decision-relevant aspects, either before or during the shareholders' meeting. If management deliberately withholds relevant information from the shareholders in their decision-making process, this constitutes a breach of duty and may even result in liability for damages (§ 43 GmbHG). Moreover, such breaches of informational duty justify the extraordinary termination of the management contract (Geschäftsführungsvertrag) and the immediate removal of managing directors for good cause.

However, shareholders can also seek information on business developments and issues outside of and independent from shareholders' meetings, as German law grants them extensive information rights. According to § 51a (1) GmbHG, the managing directors must inform every shareholder about the affairs of the company and grant them access to business documents. The managing directors must promptly comply with any shareholder's request.

The control right of the GmbH shareholder under § 51a GmbHG is, after the voting right, the most important administrative right. Therefore, the law provides strong protection for the rights to information and inspection. These rights cannot be excluded or significantly limited, even by contract and even with the affected shareholder’s consent. The information right serves as a control mechanism for minority shareholders and those not involved in management. It is intended to ensure the separation of powers within the GmbH.

It should be noted that managing directors, by virtue of their position, already have comprehensive information rights, including with respect to their fellow managing directors. This right is not derived from § 51a GmbHG but from the managerial authority inherent in the role. Non-managing minority shareholders, by contrast, must base their information requests on § 51a GmbHG.

Scope of Information Rights in German GmbH

The corporate control right under § 51a GmbHG consists of both a shareholder’s right to information and a right of inspection. Through the right to information, a shareholder may request any relevant information regarding the legal and economic affairs of the company, including relationships between the GmbH and third parties. In practice, information requests often concern:

- Financial projections by management, solvency forecasts, and planned transactions—even if only discussed informally so far

- All minutes from shareholders' meetings as well as minutes from advisory board and supervisory board meetings

- Salaries of employees and managing directors

- Invoices and all accounting documents of the GmbH

- The financial and asset situation of the GmbH

- Contracts with affiliated companies and business partners

Information may also extend to relationships within a corporate group. A shareholder may therefore also have a right to information regarding a subsidiary or affiliated company of the GmbH.

In practice, various questions continuously arise regarding the shareholder's information rights. The right of inspection extends to all documents, including those stored or archived digitally. This right encompasses all documented data, regardless of the form of documentation. Under German law, the right of inspection must be exercised on the company’s premises. However, with the consent of all parties involved, inspection may also take place elsewhere, for example, at the company’s tax advisor’s office. The shareholder cannot demand that management send copies of the requested documents. Under GmbH law, the right of inspection is a "duty of collection".

The shareholder is required to specify their request for information in a substantive manner. However, the request for inspection does not need to be detailed. The shareholder may inspect documents without a specific purpose. There is no hierarchy between the right to information and the right of inspection. The shareholder may choose either right or assert both cumulatively.

It is important to note that the information rights of GmbH shareholders can also be characterized as control rights over management. This means that the managing director has significant informational duties corresponding to the rights of the shareholders.

Refusal of Information and Disclosure (Refusal Resolution)

The right to information under § 51a GmbHG is extensive, and the managing director of the German GmbH must ensure that this important shareholder right is upheld. However, this right is not unlimited.

German corporate law allows for refusal if the requested information and inspection are likely to be used for purposes unrelated to the company, which could cause significant harm to the company, as outlined in § 51a (2) GmbHG. A refusal situation may arise, for example, if a shareholder intends to use the requested information to benefit a competing company.

From a procedural perspective, information and inspection rights cannot simply be denied by the managing director. A shareholder resolution is typically required to legitimize the refusal. The some shareholder may be subject to voting restrictions in the shareholder meeting.

In summary, the managing director can only refuse to provide information or access to company records if the company’s interests would be significantly harmed and if a shareholder resolution exists that justifies the refusal. Without a refusal resolution, the managing director is obligated to provide the requested information. Only in exceptional cases may a managing director refuse an abusive request without a resolution.

Improper Refusal of Information and Disclosure

If the managing director refuses requested information - such as details about a planned risky business transaction - without having obtained a shareholder resolution, they are in breach of their statutory duties. Such a breach may give rise to claims for damages against the managing director. Additionally, their management contract could be terminated for cause, and the managing director may be dismissed for good reason.

A similar risk exists if the managing director discloses information to a shareholder while reasonably foreseeing that the information would be used to harm the company, for example, if the shareholder uses the information to poach a key client from the GmbH. In such a case, the managing director would have been required to convene a shareholder meeting and obtain a refusal resolution.

Information Enforcement Procedure & Action for Annulment before German Courts

According to § 51b GmbHG, a shareholder whose right to information has been denied may initiate the so-called information enforcement procedure (Informationserzwingungsverfahren) before the Regional Court (Landgericht), Chamber for Commercial Matters. No specific deadline is set for this procedure by law. However, general forfeiture principles apply. The application is filed by the shareholder against the German GmbH. The Regional Court decides by resolution, which may be challenged via immediate appeal. If the appeal is granted, the Higher Regional Court (Oberlandesgericht) takes over the matter.

This procedure is distinct from actions challenging shareholder resolutions (Mängelbeschlussklagen), such as actions for annulment or nullity, when a shareholder contests the refusal resolution that denied their request for information.

In addition to these actions, shareholders may file suit under § 42a GmbHG. This provision obligates managing directors to prepare annual financial statements and imposes deadlines based on the size of the GmbH. Especially for minority shareholders, § 42a GmbHG provides a basis for legal action or interim relief to obtain timely and important information.

Q&A – Information Rights of GmbH Sharholders in Germany

With just one click, you will find answers to the most important questions regarding information and disclosure rights of a German GmbH.

What information can a German GmbH shareholder request?

Shareholders have the right to obtain information regarding the legal and economic affairs of the GmbH. Under § 51a GmbHG, this includes both the right to information and the right to inspect company documents.

Does the right to information apply to every minority shareholder?

Yes. Every shareholder in a GmbH, regardless of their ownership share, is entitled to extensive rights to information and inspection under § 51a GmbHG.

When can the managing director refuse to provide information?

Managing directors may refuse information if its use would be contrary to the company’s interests and could cause significant harm. However, a refusal resolution passed by the shareholder meeting is required.

What happens if information is refused without a refusal resolution?

A refusal without a shareholder resolution may lead to the extraordinary termination of the managing director’s contract, their dismissal for cause, and potential liability for damages.

What options exist in case of information refusal?

The shareholder can initiate an enforcement procedure before the German Regional Court (Landgericht) to compel the information under § 51b GmbHG. They may also challenge the refusal resolution via defect actions (Mängelbeschlussklagen).