Exit & Exclusion of a Shareholder from a German GmbH

Voluntary Withdrawal, Forced Exclusion & Severance Payment

Disputes between shareholders are among the most common reasons for a shareholder’s exit from a German limited liability company (GmbH). Whether a shareholder leaves voluntarily or is excluded against their will, the whole process is legally complex and often financially significant. Furthermore, every termination might have effects on the tax situation. Our experienced team of corporate lawyers advises both companies and affected shareholders on all aspects of voluntary and forced exits as well as on severance compensation claims.

Our Expertise on Exit & Termination of GmbH Shareholdings

Our corporate lawyers have years of expertise in shareholder disputes and cases regarding exit and forced exclusion of shareholdings. Together with our tax consultants, we advise on all matters relating to the termination and withdrawal of shareholders from the GmbH, such as:

- Strategic advice in the run-up to the voluntary or forced withdrawal of a shareholder from the GmbH including strategies to avoid liability.

- Legal and tax structuring of the severance payment according to Vesting and Leaving programs and negotiations of withdrawal agreements

- Preparation of resolutions and shareholders' meetings for the purpose of exiting shareholders and resolving deadlock situations between shareholders

- Court representation of companies and shareholders in disputes over the termination and exclusion from the GmbH as well as the conduct of arbitration proceedings

- Measures in interim relief, for example injunctions in the event of compulsory exclusions of shareholders and criminal defense in case of criminal charges (infidelity in the GmbH)

For a non-binding inquiry, please contact one of our colleagues directly by phone or e-mail or use the contact form at the end of this page.

Voluntary Exit: Withdrawal of a Shareholder from a German GmbH

According to German law, shareholders may decide to leave the GmbH for various reasons. One of the most common reasons are disputes with co-shareholders, the C level and a lack of trust in the company’s future. Often retirement, or the shareholders‘ desire to realize the value of their shares is a reason to leave the company. The process for leaving the German GmbH might be legally complex and sometimes a shareholder can even be „locked up“ in the GmbH. If a shareholder intends to leave the GmbH voluntarily, there are generally three options:

- Termination of Shareholding / Withdrawal from the Company

- Dissolution Action filed by the Shareholder

- Sale of the Shareholding in the GmbH

Below, we will provide a more detailed overview of the different forms of voluntary withdrawal from a GmbH.

1.1 Termination / Withdrawal by a Shareholder

Under German corporate law, a distinction is made between ordinary termination and extraordinary termination of a shareholder’s position in the company.

A shareholder may terminate their position through ordinary termination. However, an ordinary termination is only possible if the articles of association explicitly provide for such an option. In this context, long notice periods, sometimes several months or even years, and specific consequences of termination must generally be observed. Often, the articles of association stipulate that in the event of termination of a shareholding, the shareholder will be entitled to a compensation payment.

If there is no regulation of an ordinary termination in the articles of association, only immediate extraordinary termination (außerordentliche Kündigung) may be considered. According to German case law, such extraordinary termination is possible even in the absence of an express provision in the articles of association (unlike ordinary termination). However, it requires the existence of a compelling (extraordinary) reason. Such a reason may originate from the shareholder seeking termination, from other shareholders, or from the company itself. An important reason is always deemed to exist if it would be unreasonable to expect the terminating shareholder to remain a member of the company. The agreements between the shareholders may define specific events or circumstances that constitute an important reason.

Under German law, following ordinary or extraordinary termination, the shares in question must be redeemed by resolution of the shareholders. The outgoing shareholder is then entitled to a compensation payment for his redeemed shares. According to prevailing court rulings, the compensation must generally reflect the fair market value of the affected shares.

1.2 Dissolution Action by the Shareholder

As an alternative to termination, a shareholder may file a dissolution action (Auflösungsklage), which allows the shareholder to leave the GmbH. Pursuant to § 61 GmbHG a GmbH may be dissolved by a court judgment if (a) the corporate purpose can no longer be achieved, or (b) other compelling reasons arising from the company’s circumstances exist that justify dissolution.

Unlike termination, a successful dissolution action leads to the winding up of the entire company, which typically results in a significant reduction in the company's value—and consequently, the value of the departing shareholder’s interest. Due to this disadvantage, the dissolution action is rarely used in corporate practice as a suitable means of withdrawal.

Nevertheless, bringing such an action may be strategically useful in individual cases, particularly to increase negotiation pressure or as part of broader legal tactics.

1.3 Sale of the GmbH Shareholding

If a shareholder wishes to exit the GmbH—e.g., because they intend to start their own business in the same industry and are prevented from doing so by a non-compete clause in the articles of association—they may also consider selling their shareholding to the other shareholders or to a third party.

However, such a sale of shares in a GmbH is typically subject to the approval of the other shareholders. In addition, planned sales to third parties may be hindered by pre-emption rights (Vorverkaufsrechte) in favor of the existing shareholders. Any shareholder considering the sale of their GmbH shares should therefore carefully review the articles of association. Most GmbH agreements contain a so-called transfer restriction clause (Vinkulierungsklausel), which requires the consent of the other shareholders for any intended share transfer. Nonetheless, in certain cases, a refusal of such consent may give rise to alternative legal exit options.

If neither transfer restrictions nor pre-emption rights prevent a sale, the transaction will follow general procedures. The selling shareholder must ensure that the prospective buyer is provided with all relevant information about the company. Typically, the buyer will wish to conduct a due diligence review before proceeding with the acquisition.

Compulsory Exclusion of a Shareholder from a German GmbH

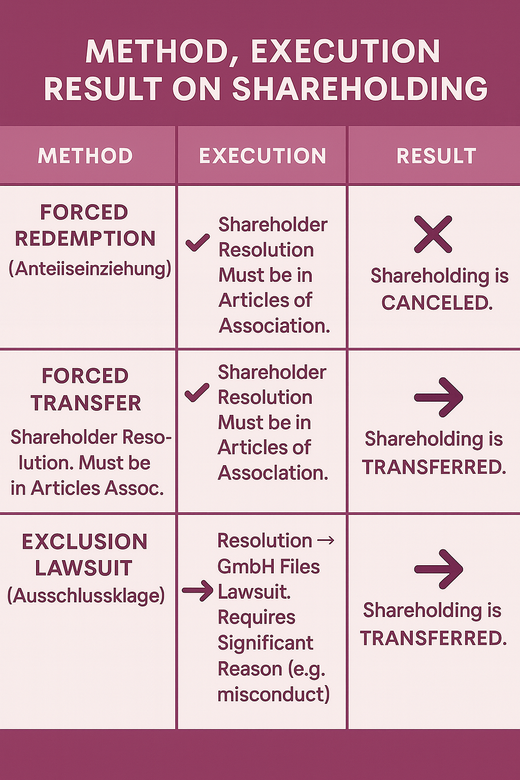

The exclusion of a shareholder from a GmbH can be initiated by another shareholder or by the GmbH itself. Compulsory exclusion takes place against the will of the shareholder concerned. One of the most common reasons for forced exit of a shareholder in practice is the accusation of a breach of trust within the group of shareholders. The German GmbH law does not recognize a general right to expulsion. However, there are three generally accepted methods for forced removal:

Compulsory withdrawal of the shares held by the affected shareholder (forced redemption of shares) - in Germany known as “Anteilseinziehung”.

Forced transfer of the shareholding to other shareholders, to the GmbH or third parties.

Expulsion of the affected shareholder through a court judgment (expulsion lawsuit). In Germany, we refer to this as a “Ausschlussklage”.

All methods lead to a forced shareholder's exit, with differences in execution: Through forced withdrawal/redemption, the shareholding is canceled, leading to the exclusion of the shareholder from the GmbH. Forced transfer results in the GmbH shareholding of the affected shareholder being transferred to other shareholders, third parties, or the GmbH itself. The shareholding itself remains in place. In the case of expulsion by court judgment, the shareholding remains intact, and only the shareholder is leaving the company. The shareholding is, depending on the provisions of the articles of association, transferred to the other shareholders, a third party, or even the GmbH itself, similar to the forced transfer. Such forced measures, which are associated with significant financial consequences for the affected shareholder, often lead to lawsuits against the GmbH. In most cases, the company must expect a dispute over the validity of a resolution. It is not uncommon for months or even years of litigation to follow after a shareholder’s expulsion.

2.1 Compulsory Withdrawal / Redemption of GmbH Shares

A shareholder's exit through the forced redemption of the shares held by the affected shareholder can only be considered if the articles of association provide for a such possibility. Without such a provision, a forced redemption against the will of a shareholder is not permissible. Additionally, the articles of association must clearly specify the conditions under which forced redemption should take place. Redemption according to German corporate law must be initiated through a shareholder resolution in the shareholders' meeting. Generally, it does not require a court ruling. The redemption process raises many detailed questions after the redemption resolution, such as:

How quickly can the shareholder register or the list of shareholders be updated after the forced redemption?

How long can the excluded shareholder still attend shareholder meetings?

Must the affected shareholder still be informed about the ongoing business?

How is the GmbH valued and how much is the severance pay?

Could the remaining shareholders be personally liable if the GmbH is unable to pay the severance payment, for example, due to company insolvency?

These questions should be addressed and carefully planned for the redemption process. Compulsory redemption will only succeed if as much as possible is not left to chance.

2.2 Forced Transfer of Shares

The forced transfer of shares, like the redemption of shares, is decided in a shareholders' meeting. It is only permissible as a coercive measure against the will of the affected shareholder if it is provided for in the articles of association. As with redemption of shares, the requirements for valid reasons for a forced transfer are very high.

After a valid resolution for forced transfer, the transfer must still be executed. This means that the transfer of GmbH interest must be organized beyond the shareholder resolution. If the articles of association do not specify the powers of representation and disposal in favor of the shareholders enforcing the forced transfer, the execution of the share transfer can only be achieved with the assistance of the court, as the affected shareholder typically refuses to cooperate.

It is very important that the procedure for the shareholders' meeting is conducted correctly in the case of a forced transfer of shares. Procedural errors could otherwise make the forced transfer resolution subject to legal challenge.

2.3 Exclusion Lawsuit

The exclusion lawsuit in Germany requires a prior resolution by the shareholders. After a resolution to exclude the shareholder in the second step the GmbH files an exclusion lawsuit against the respective shareholders. The lawsuit is successful if there is a significant reason for the exclusion of the shareholder. Such a reason exists, particularly when it becomes unreasonable for the other shareholders to allow the shareholder to remain, for example, if a shareholder embezzles company funds or violates existing non-compete clauses. General information on litigation procedures can be found here: Litigation in Germany.

It is advisable that all measures, like redemption, forced transfer, and exclusion, be expressly regulated in the articles of association. Special attention should be given to clearly defining the conditions, procedures, and economic consequences for each. In addition to the legal and economic aspects of shareholder exclusion, the tax framework is also highly relevant in practice.

Exit Compensation for the Departing Shareholder

It has already been pointed out that every departing shareholder is entitled to a compensation claim against the GmbH. Only in the case of forced transfer does the affected shareholder not receive compensation from the GmbH, but rather from the party taking over the shares.

All the forms of a shareholder’s exit from the GmbH described above lead to the question of how much compensation the shareholder will receive and who will pay and possibly finance this compensation. Key questions regularly arise concerning the correct method of company valuation, who is authorized to carry out the valuation, and who will bear the costs for such a valuation.

If you are interested in receiving legal advice or representation from one of our specialized attorneys and legal experts, feel free to contact our representatives at our offices in Hamburg, Berlin, Hannover, Munich, Cologne, and Frankfurt. We are happy to provide you with both legal and strategic guidance on shareholder disputes, as well as on matters relating to compensation and company valuations.

Q&A – GmbH Termination, Withdrawal, and Expulsion of Shareholders

With one click, you can find the answers to the most important questions about shareholder termination, withdrawal, and expulsion from the company.

Can a shareholder withdraw from the GmbH?

A shareholder can withdraw from the GmbH through a termination if the articles of association provide for an ordinary termination of the shareholder relationship. In contrast, an extraordinary termination of the shareholder relationship is always possible. This cannot be excluded by the articles of association.

Is a shareholder liable after withdrawing from the GmbH?

A shareholder of a GmbH is protected from personal liability under § 13 para. 2 GmbHG. This legal limitation of liability applies even after the shareholder has withdrawn, so the shareholder is generally not liable.

What options does a German shareholder have to exit the GmbH?

A shareholder generally has three options to voluntarily exit from the GmbH: 1. The shareholder can resign through termination if the articles of association provide for such termination. 2. The shareholder can sell their GmbH shares to other shareholders or third parties. 3. In certain cases, the shareholder may also have the option to file a lawsuit for dissolution.

Can a shareholder be forced to leave the GmbH?

In principle, the expulsion of a shareholder is prohibited. However, a shareholder can be forcibly expelled from the GmbH if there is a valid reason (e.g., in the case of a serious breach of duty by the shareholder).

Does a shareholder have a right to compensation after leaving the GmbH?

In principle, every shareholder is entitled to compensation from the GmbH. They are entitled to a compensation based on the market value of their shares. However, the company's articles of association may impose restrictions on the compensation (Abfindungungsbeschränkungen). That said, excessively broad compensation restrictions may be deemed invalid according to case law.