Shareholder Dispute in a German GmbH

Attack on Shareholders & Managing Directors – Exclusion, Redemption & Termination

Disputes between shareholders are usually very complex. Conflicts that escalate often lead to the exclusion of a shareholder or managing director from the company. For those affected, the loss of their shareholding position in the company can affect their financial existence.

As a commercial law firm specializing in corporate law with lawyers and tax advisors, we advise companies, shareholders, investors and managing directors in all phases of an intra-company dispute.

Our Expertise in Shareholder Disputes (Corporate Litigation)

Our Team of specialized corporate lawyers offers you extensive experience from hundreds of assisted corporate disputes at shareholder and management level. Our advice covers all legal, psychological and tactical aspects of a business conflict. The range of our service includes in particular:

- Preparation of shareholder meetings. We plan strategies regarding redemption of shares.

- Enforcement of shareholder rights by means of legal action against co-shareholders or the GmbH itself as well as arbitration proceedings.

- Enforcement of shareholder right to information in a GmbH.

- Compensation claims following the loss of shareholder status.

- Full tax support at the company and shareholder level.

- Legal advice on the dismissal or resignation of the managing director.

- Criminal defense in the event of allegations of breach of duties within the GmbH and in case of hidden profit distributions (vGA).

- Planning of separation strategies and effective conflict coaching under German company law.

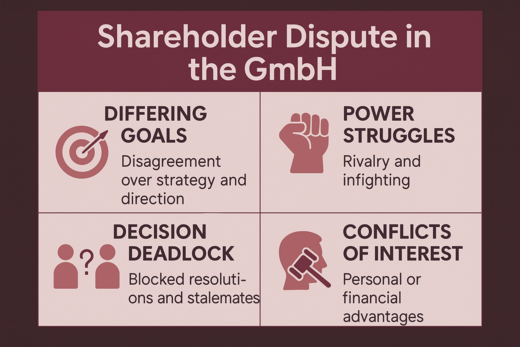

The Threat of Conflict

In traditional medium-sized German companies, there is often a close relationship between the shareholders. Some conflicts can have a significant effect on the business operations and negative financial consequences for the company.

If disputes occur the majority shareholders are exploiting the balance of power to harm opponent shareholders. Should one shareholder begin to take destructive measures (e.g. discharging a managing director or hurtful resolutions concerning the distribution of profits) the shareholders concerned react in a harmful manner and the conflict starts to escalate.

Furthermore, a dispute frequently influences the managing director’s position. This applies not only to companies where the shareholder is a managing director but also for companies with external managing directors. In general, an escalating conflict affects many stakeholders connected to the company such as clients, suppliers and other business partners, banks and employees. Reputational damage then becomes unavoidable.

Lack of Shareholder’s Minority Protection

The majority shareholders rule the GmbH. According to the German Limited Liability Companies Act shareholder’s resolutions are passed by simple majority. Thus, the majority shareholders control the managing board and the whole company. They can give the managing director binding instructions which can harm the minority shareholders. Although the German GmbH law does provide a certain degree of minority protection, there are considerable gaps in protection.

In the business world you can watch a so-called “starvation of shareholders”. This means that the majority shareholder prevents a profit distribution which must always be decided by the majority of the voting rights. By retaining profits in the GmbH, the majority shareholder can severely impair the financial interests of the minority shareholders, especially if they are dependent on the GmbH’s income.

If an affected minority shareholder is part of the managing directors’ team, attacks worsen its financial hardship. The dismissal and notice cancellation of the managing director may be resolved by a simple majority of votes if the affected minority shareholder under attack does not have contractually agreed special rights, for example a reservation of approval or a locking minority. To summarize, this means that a disturbed relationship in the group of shareholders often leads to a situation where the minority shareholder could be put under serious pressure.

In fact, according to German case law the majority shareholder is prohibited from abusing its shareholding rights. Majority resolutions are subject to judicial abuse control. However, there is still plenty of room for strategic maneuvering. One major disadvantage for minor shareholders is that contested majority resolutions remain effective until the court decision, which may take some time.

Furthermore, the minority shareholder who takes legal action against the resolution must finance the litigation costs. Another disadvantage for the minority shareholder is that it is not the majority shareholder but the company that is being sued. That means that the company bears litigation costs and there is no cost risk for the opposing majority shareholder himself. Moreover, the minority shareholder bears the burden of proof that the resolution is abusive. In German court proceedings the majority shareholder can claim many systematic advantages. Finally, the advantages extend far beyond the court proceedings. For example, the majority shareholder can prevent shareholder meetings on which the minority shareholder is dependent.

Special Situation: Dispute between 2 Shareholders with 50% shareholding

The situation in a two-tier company in which both shareholders have a stake of 50 %, is a special case from a legal point of view. We rarely face a typical majority and minority conflict. Since both shareholders have the same voting rights we are often faced with a deadlock in the German GmbH. These two-tier companies will not have a classic shareholder conflict regarding a majority resolution. Such deadlock leads often to a fight between the shareholders where one tries the other one to remove from the company. The attacked shareholder again reacts with an exclusion of the aggressor shareholder.

Hence, these conflicts often end up in a reciprocal cancellation of shareholders. The exclusion measures are carried out at shareholders’ meetings. They are enforced by means of so-called withdrawal orders (“Einziehungsbeschlüsse”). From a legal perspective, shareholders against whom withdrawal orders for good cause are passed are subject to a voting ban.

Disputes in Joint Verntures

In Germany, joint venture structures are often implemented through a GmbH (limited liability company). The contractual frameworks governing these ventures are typically very complex. When disputes arise between joint venture partners, they often involve fundamental questions: Who is authorized to act on behalf of the company? How can a deadlock between shareholders be resolved? And what legal remedies are available if one partner violates the agreed terms? These conflicts can quickly escalate and require precise legal assessment, especially regarding fiduciary duties, cooperation obligations, and potential exclusion or dissolution scenarios. Such disputes can only be effectively resolved with the support of specialized legal counsel.

Exclusion of a Shareholder by Way of Legal Action

If the conflict between the shareholders is significant and cannot be resolved amicably, the question of the compulsory exclusion of the co-shareholder quickly arises. Below are the most important questions regarding the compulsory exclusion of shareholders in a German GmbH.

Can I exclude a shareholder by filing a lawsuit? If the articles of association do not explicitly permit a resolution on exclusion, forced redemption, or compulsory transfer of shares, a shareholder can only be excluded from the company by means of a court judgment — the so-called action for exclusion (Ausschlussklage). Even in such cases, the lawsuit requires the existence of good cause (wichtiger Grund) justifying the compulsory exclusion of the shareholder.

What are the disadvantages of the exclusion action? The exclusion action has one major strategic disadvantage. An exclusion action against a fellow shareholder must be approved by resolution in a shareholders’ meeting. Only in a second step will the exclusion be decided by a court ruling, which can take years to reach final judgment. The exclusion action is essentially a fallback option for situations where the articles of association do not permit a resolution for redemption or forced transfer.

Redemption of GmbH shares and forced transfer

In addition to a shareholder exclusion via lawsuit, a shareholder may also lose their position through a shareholders’ resolution - specifically, a resolution for redemption or forced transfer based on good cause. In the case of redemption, the affected shareholder’s share is dissolved. The expulsion of a shareholder through a redemption resolution is only possible if such redemption is provided for in the articles of association and there is good cause.

Good cause may exist, for example, if the shareholder has embezzled company funds in breach of fiduciary duty or has engaged in competition with the company. The articles of association may define specific grounds. Once the redemption becomes effective, the excluded shareholder is entitled to a compensation claim against the GmbH.

In the case of a forced transfer, the shares are not destroyed but instead transferred to another shareholder, the company itself, or a third party. A forced transfer also requires good cause. The departing shareholder must be compensated by the recipient of the shares.

The corporate law procedure of the redemption and forced transfer resolutions can be very complex in practice. The affected shareholder often utilizes various strategies (procedural flaws and counterattacks) to avoid being excluded from the company. The affected shareholder can challenge the redemption resolution through so-called resolution defect lawsuits (Beschlussmängelklagen).

Termination at the Initiative of the Shareholder (Exit Resignation in the GmbH)

Can an affected shareholder voluntarily leave the GmbH against a severance payment (Abfindung), such as through a resignation? In principle, a shareholder can effectively resign from their position as a shareholder of a German GmbH if they have the option of ordinary termination. However, they can only terminate the relationship with the GmbH under ordinary termination if the shareholders’ agreement explicitly provides for this option. If the shareholders’ agreement is silent on the issue, only resignation good cause is always possible.

Severance Payment After Termination, Exclusion, or Withdrawal

When will I, as a shareholder, receive a severance payment and how does the payment process work? Regardless of how an individual shareholder loses its shareholder status, he or she is entitled by German law to a severance payment (often referred to as the "withdrawal or exclusion compensation / Einziehungs- oder Ausschlussentgelt"). This entitlement to compensation only arises once the shareholder status has been lost. In practice, severance payments often need to be enforced through legal action, as the remaining shareholders may refuse to pay the appropriate compensation. The burden of initiating legal action and the associated costs generally fall on the affected exiting shareholder. In the case of a large severance payment, it may be possible to arrange for litigation financing.

Is Exclusion from Severance Payment Possible?

A complete exclusion of the severance payment or an excessive reduction of the severance payment through provisions in the GmbH's articles of association is considered unlawful by the German courts. However, an exception exists: according to case law, a complete exclusion of the severance payment in the event of a shareholder's death is allowed. If such a provision is included in the articles of association, the heirs will not receive any severance payment. In all other cases, a severance payment must be made. However, it is possible to agree on the amount of the severance payment in the context of a dispute. Especially in cases where the severance payment is reduced, the tax consequences, including potential gift tax issues, should always be carefully reviewed.

How High Is the Severance Payment?

When a shareholder is excluded from the company, their shares are revoked, or they voluntarily leave the company, a dispute often arises over the amount of the severance payment. In principle, the severance payment is based on the so-called market value of the company, which is usually determined using a common earnings value method. In determining the severance payment, the affected shareholder relies on experienced lawyers and tax advisors who can competently assist with both the valuation of the company and the procedural challenges involved.

Dismissal of the Managing Director, Termination of the Managing Director's Contract

In business practice – not only during shareholder disputes – it is often crucial for active shareholders to "control" the managing director of the GmbH or to take on the management themselves. The managing director's role often plays a central part in shareholder conflicts. Therefore, managing directors are often involved in shareholder disputes, and their position as an executive body, as well as their management contract, can be challenged during shareholder meetings.

Under what conditions can a managing director be dismissed? In principle, a third-party managing director can be dismissed without cause by a majority vote of the shareholders. However, the managing director's employment contract can only be terminated within the regular notice period. If the managing director has violated their duties, immediate extraordinary termination of the employment contract may be possible. In practice, cases of embezzlement within the GmbH are particularly relevant. Through legal voting bans and corporate loyalty duties, it is even conceivable that a minority shareholder can achieve the dismissal and termination of the managing director's contract for good cause.

What happens to the managing director's service contract and their entitlement to ongoing remuneration? In addition to the dismissal of the managing director from office, the termination of the managing director’s service agreement should – or in many cases must – also be carried out. Terminating the service relationship requires a separate shareholder resolution. The termination itself must be made in writing.

In cases of extraordinary termination, the two-week notice period under sec. 626 para 2 BGB (German Civil Code) applies. This means the termination must be issued within two weeks after the shareholders’ meeting becomes aware of the relevant cause.

Resignation and Termination by the Managing Director of a GmbH

Shareholder disputes are frequently caused by - or lead to - financial distress within the GmbH. In such cases, the demands on the managing director increase, as do their risks of liability. To limit exposure to such liability risks, managing directors often seek to resign from office (Amtsniederlegung) and terminate their service agreements.

How can a managing director resign early? Under German law, a managing director may generally resign from office at any time and without providing a specific reason. The resignation from office is typically accompanied by the termination of the underlying service agreement with the GmbH. However, resignation is not permitted if it occurs at an inopportune moment (“zur Unzeit”), such as during a crisis when the company is particularly reliant on their leadership.

What are the liability risks associated with improper resignation? If a resignation is abusive or occurs at an inopportune moment and causes damage to the company, the managing director may be held personally liable. Whether resignation during a period of financial difficulty is legally permissible depends on the specific circumstances and must be assessed on a case-by-case basis.

To avoid liability risks, the resignation should be duly registered with the German commercial register (Handelsregister). Otherwise, the managing director may continue to face personal liability despite no longer actively managing the company. A comprehensive termination or separation agreement (Aufhebungsvereinbarung) between the managing director and the GmbH is often a sensible way to clearly define rights, obligations, and release from liability.

If you require legal advice or representation in corporate law matters, please contact our offices in Hamburg, Berlin, Munich, or Frankfurt. Our team of attorneys advises and represents clients in shareholder disputes throughout Germany and internationally.

Our lawyers in Hamburg, Berlin, Munich, Frankfurt a.M. and Cologne

All of our lawyers who advise shareholders or managing directors of limited liability companies are either specialists in German corporate law.

Q&A – Shareholder Disputes in a German GmbH

Click here to find answers to the most frequently asked questions concerning shareholder conflicts involving shareholders and managing directors in a GmbH under German law.

What should I consider in case of a shareholder dispute in a German GmbH?

Under German law, shareholder disputes typically surface during shareholder meetings. Hostile shareholder resolutions may lead to voting prohibitions or obligations to vote in a specific manner. It is crucial to have the legal situation reviewed by specialists at an early stage, especially before contentious shareholder meetings take place, as resolutions that are duly adopted and confirmed can have far-reaching consequences.

Which rules apply in a shareholder dispute in a German company?

In the event of a shareholder dispute, the applicable rules depend on the legal form of the company. In Germany, for GmbHs, the German Limited Liability Companies Act (GmbHG) applies; for stock corporations, the German Stock Corporation Act (AktG); and for partnerships, the German Commercial Code (HGB). These laws define the relevant responsibilities, rights, and powers of shareholders and other corporate stakeholders.

Can a shareholder be excluded from a German GmbH?

A shareholder can be excluded from the GmbH by means of a shareholder resolution (compulsory redemption) or by way of an exclusion action, provided that good cause exists.

When is the exclusion of a shareholder possible?

Exclusion by way of a shareholder resolution is possible if the articles of association provide for such a resolution. A compulsory exclusion requires good cause. In most cases, a shareholder is excluded through a resolution ordering a redemption of shares or a forced transfer. If the articles of association do not contain provisions on shareholder exclusion, the only remaining option is to file an exclusion action (Ausschlussklage).

What is a redemption in a GmbH?

A redemption can be resolved by the shareholders of a GmbH to invalidate shares. If all of a shareholder’s shares are redeemed, the shareholder loses their status as a shareholder of the company.

Does the excluded shareholder receive compensation?

In principle, a shareholder excluded from the GmbH is entitled to compensation, unless this is explicitly excluded by the articles of association.

How high is the compensation for an excluded shareholder?

The amount of compensation is determined by the articles of association. If the articles of association do not specify the amount of the compensation, it is based on the market value of the shareholding.